In Numbers: Cloud Technology In FSI

Unlocking Digital Transformation Numbers for the Financial Services Industry (FSI) in GCC

As the UAE Cloud services market is expected to reach $2.97 Billion in 2026, a recent IDC research, examined in our latest event, reveals the Cloud as a springboard for innovation in the GCC, particularly for the Financial Services Industry (FSI). While organizations in various industries are progressively striving to adopt a digital-first approach, 32% of financial services companies according to the study, have already leveraged Cloud to build and drive an extensive ecosystem of partners.

These insights aim to better equip you with the knowledge of where the Financial Service Industry currently stands in the GCC – with a great focus on the UAE market – in Cloud Adoption & Digital Transformation, to help you take stronger business decisions.

Value-Adds and Future Spent.

As more organizations are planning to significantly boost their investments in Digital Transformation (DX) initiatives, the IDC research projects equal spending on Traditional IT and DX by 2025, brought by the need for businesses to effectively compete in the market and optimize operations at every stage.

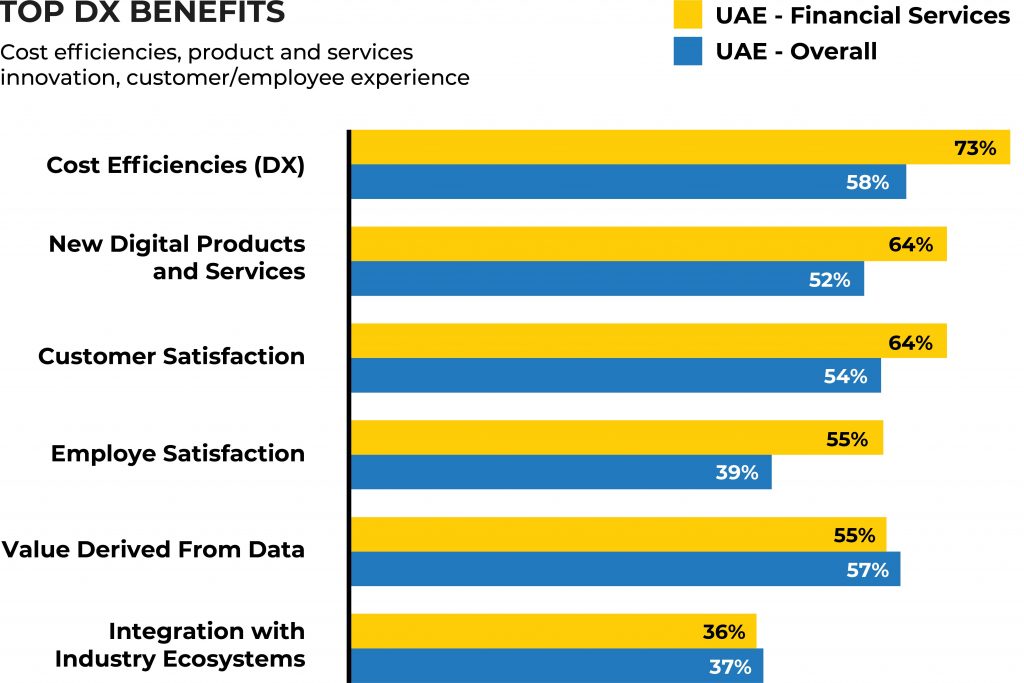

Driven by the value derived from Data and DX initiatives in key areas such as increased cost efficiencies, ability to launch new products/services, and improved customer & employee satisfaction rates, the FSI has greatly benefited from the shift to the Cloud.

Leadership and Early Adoption.

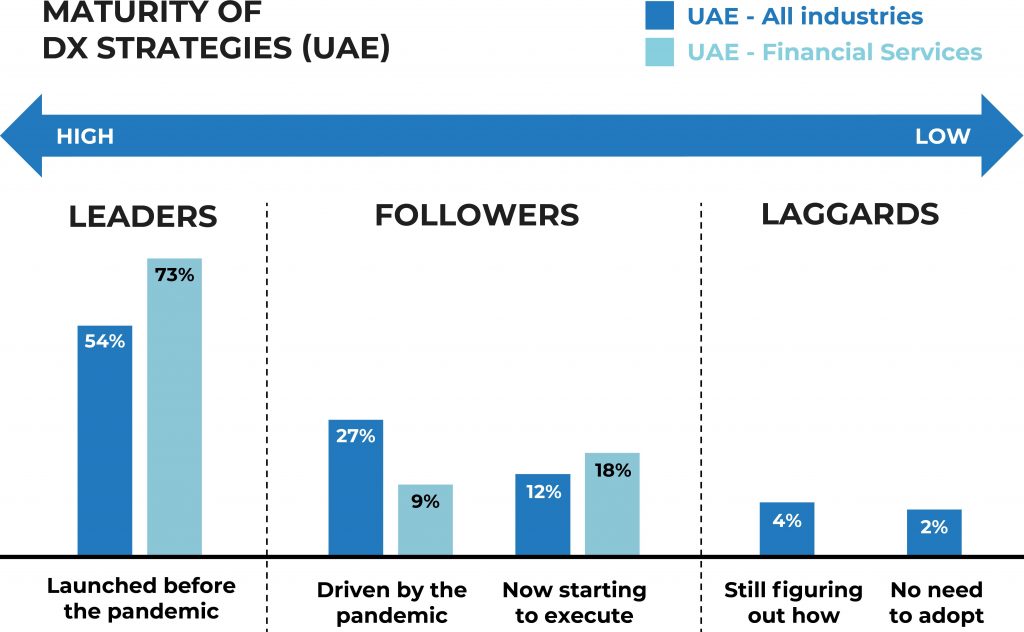

When compared to other industries, the FSI has proved readiness for Cloud Adoption and DX initiatives at early stages, where the study shows that 73% of the financial leaders had already launched their DX strategies pre-pandemic and 44% of organizations recently completed a core platform transformation.

While 51% of organizations are also considering their core transformation, the biggest drivers for change observed by the study are to offer next-gen products and services and enhance their front-end experience through open banking API, modular & microservices architecture, low code / no code upgrades, and unlocking cloud-native solutions.

Migration Roadmap

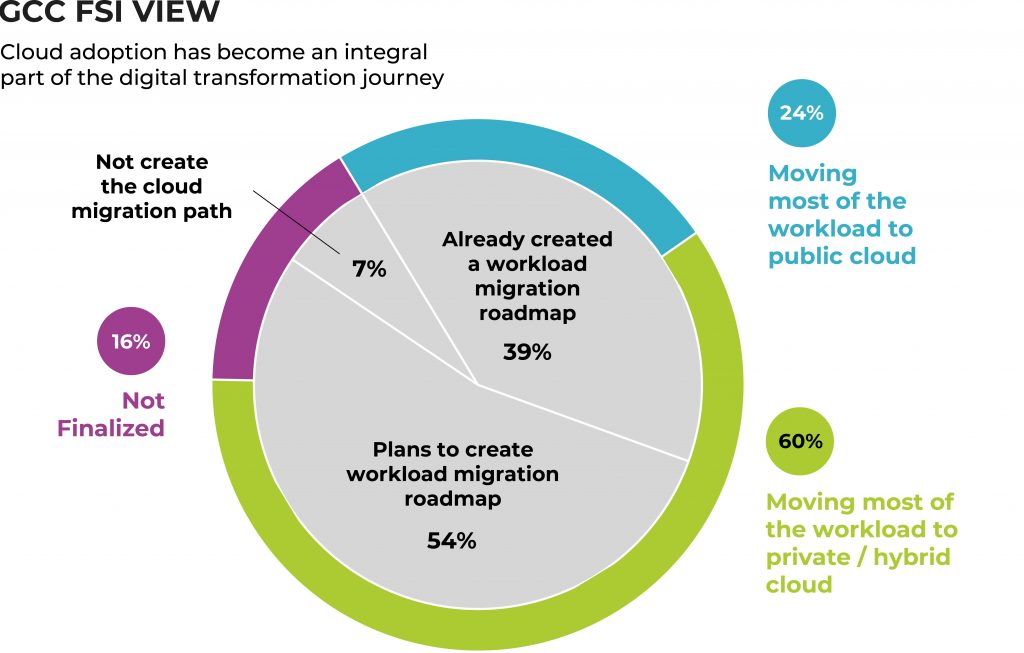

Cloud adoption becoming an integral part of this transformation journey, the study confirms that 93% of financial organizations either possess a complete workload migration roadmap or are currently developing one.

Additionally, 60% of organizations in the Industry plan on having most of their workloads onto a private/hybrid cloud model whereas 24% are considering public cloud models.

App Deployment Strategies for the next 2-3 years.

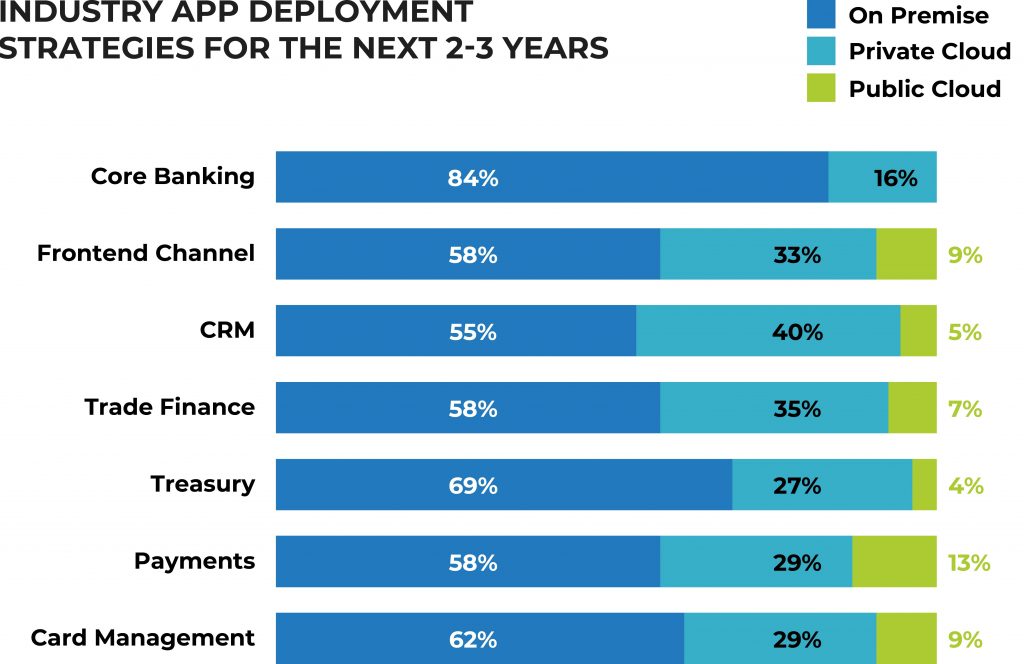

Although most of the applications are still hosted on-premises, private or public cloud models are largely being considered by financial institutions to host applications related to CRM, trade finance, and front-end channels.

The Way Forward

The shortage of cloud professional services companies with relevant industry expertise and cloud lifecycle experience in the GCC is portrayed by the study as a decelerator for cloud adoption where companies have reported a prolonged/inefficient implementation, poor integration experience, lack of governance & management, poor technical support and customer service, and high costs and fees than promised earlier.

It is thus important for FSI companies to partner with the right solutions provider to help choose the best platform and migration strategy that will not only help meet their future strategic goals but also integrates well with existing on-premise databases.

TALK TO OUR EXPERTS